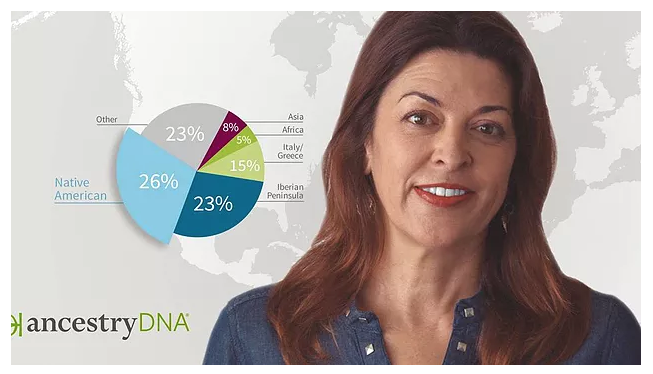

My son has been conducting extensive research into our family history and has spent a lot of time creating a family tree. He has asked many in our family to take genetic/DNA tests as part of that research to learn more about our genealogy.

The article linked below from the Miami Herald discusses how insurers, including long term care, life, and disability, have asked potential insureds whether they have undergone genetic testing. The author of the article suggests that if an insurer asks for this information, the insured must provide it. I agree, as long as it is before the issuance of the insurance policy.

I have significant experience litigating cases where an insurer has attempted to cancel life insurance policies when it believes that that the insured was not upfront with the insurance company in providing information during the underwriting process. In Florida, the life insurance company can re-review all of the information provided during underwriting and seek additional information related to the insured, so long as this occurs within two years of the issuance of the policy. This is called the contestability period and if the insurer learns of additional information that would have caused it to issue the policy at a different premium amount or refuse issuance of the policy, it can cancel the policy – – – even after the insured’s death, and even if the insured’s death was unrelated to this information. As a result, I certainly recommend that any insured provide to the insurer all relevant information that it asks for, including information related to genetic testing.

Are you, a friend or loved one having difficulty obtaining life insurance benefits? Cotzen Law can help.