Millions of homeowners have had trouble paying their mortgages in light of the COVID-19 pandemic. Many borrowers lost their jobs or had their income reduced during the pandemic and were thus unable to pay their obligations to their lenders. For instance, April 2020 saw the largest single-month surge in mortgage delinquencies in history, jumping by more than 1.6 million. Miami topped the list of large cities with the biggest increases. While mortgage foreclosures were suspended for many months, lenders have again begun filing foreclosure actions against their borrowers who have not made their required mortgage payments.

Many lenders worked with their borrowers at the beginning of the pandemic to modify loans or to forbear the payments by moving the payments to the end of the mortgage obligation. Some agreed to provide forbearance agreements for up to a year. Forbearance is an agreement with your mortgage company that allows you to reduce or delay payments for a set time. During the early stages of the pandemic, requests for mortgage forbearance increased by as much as 2,000 %. Borrowers must understand that mortgage forbearance is not mortgage forgiveness. A forbearance agreement allows a borrower to pause or reduce payments for a period of time without the lender starting the foreclosure process. In return, the borrower agrees to resume payments when the forbearance time ends and pay the additional deferred amount, including principal and interest, to bring the account into good standing. A forbearance agreement is akin to putting off the payment until a later day.

The manner in which the deferred money is paid back can make all the difference. Mortgage companies can require homeowners to pay the deferred portion in one lump sum. But in some cases, the borrower may be able to negotiate with their mortgage servicer to pay extra each month until the deferred amount is repaid or add the suspended payments to the end of the loan.

Another option is to apply for a loan modification, in which the lender might add the deferred amount to the balance, increase the length of your loan or reduce the interest rate.

However, while the measures should have created a feeling of relief, many borrowers have been left anxious because of confusing messages from the government and banks. Some homeowners say Wells Fargo, Bank of America, Chase, and other lenders have told them they have to repay those postponed payments in a lump sum once a certain time period expired. This was an unexpected demand that homeowners feared could put them deeper in debt as they struggle financially.

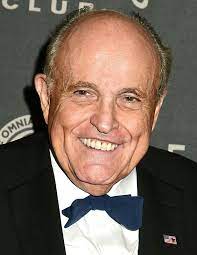

I am an attorney who has handled hundreds of foreclosure actions and won more than my fair share of cases against the biggest banks in the world. I also was the recipient of an award from the South Florida Daily Business Review for the Most Effective Lawyer in Miami-Dade County in cases involving distressed real estate as a result of a foreclosure matter which prevented my client’s million dollar home from being foreclosed upon. I wanted to share a number of things that homeowners can do to assist themselves in what could be an extremely important dispute and potential litigation in an effort to save their home against a bank with endless resources and access to attorneys:

- Definitely do not fight this battle without an attorney. I understand that times are tough and money is tight. However, the battle is already unbalanced as you will likely be fighting against a multi-billion dollar company. Your lender will surely have counsel advising it and you need an attorney as well. Your money will be well spent, provided that you are careful to hire an attorney who has experience in representing borrowers in foreclosure defense cases. Be careful hiring an attorney, look at online reviews, and find an attorney who you trust and are comfortable in representing you. If you find the right attorney, they will be able to provide significant value to you.

- If you are communicating with your lender regarding a modification or forbearance, be sure that those communications are in writing. If your lender makes important statements on phone calls, ask if they can put those statements in writing. They may be important in a subsequent litigation.

- If you are submitting documents online, be sure to obtain and save confirmation of the receipt of these documents and have a copy of what you submitted.

- Save your documents, including all communications with your lender. They may be important.

- Be sure to have records of all of your payments to the lender.

- A mortgage can be owned by a bank, or a bank can service a loan backed by government-sponsored enterprises such as Fannie Mae, Freddie Mac or agencies such as the FHA, which were set up by the government to support and finance the housing market. Know who backs your mortgage as different rules may apply.

- If you can pay your mortgage, I advise continuing to do so. But if you are experiencing financial hardship because of the pandemic or for other reasons, call your servicer immediately and ask them what forbearance or other relief options are available. An open line of communication that can be documented is vital.

- If you pay your property taxes, insurance or association fees directly, those expenses are not included in the forbearance or a modification. Continue to pay them or make other payment arrangements. Do not stop paying the association as defenses to a foreclosure action brought by an association are difficult to maintain.

- Even if you obtain a forbearance or modification, you should still seek the guidance of a competent attorney. You should ask questions, understand the terms, and know when the loan is to be paid back.

- If you are served with a lawsuit, do not ignore it. Hire an attorney immediately to handle your defense (even before the lawsuit is filed if the lender has sent correspondence indicating its intent to sue). You have a definite period of time to respond – usually 20 days – and you do not want to leave the response or the hiring of an attorney until the last minute. That will put you at a disadvantage. If you fail to timely respond, you may lose your ability to defend the case in court.

If you are in need of an experienced attorney who is comfortable handling foreclosure defense cases, please contact my office at 305-682-1600 to schedule a consultation.